Supply chain, two words that until recently were only really familiar to those working in the sectors where they play a crucial role.

When something works smoothly the vast majority of people do not even realise it is a factor in their everyday lives: they can buy any product they like when they like, supermarket shelves are full, staples and luxuries are freely available, there is plenty of choice. But...

Recent events have overturned this situation, bringing the words ‘supply chain’ to the forefront of the public’s awareness. Covid-19, the war in Ukraine, climate change, Brexit in the UK, have all impacted people’s everyday lives.

Shelves empty of toilet paper during the early stages of Covid 19, delays in production and delivery of household appliances and new cars, supermarket shelves lacking certain fruit and vegetables in the UK, are all due to supply chain issues caused by upheaval, natural or man-made or a combination of the two.

What is a supply chain?

In simple terms, supply chains focus on the efficient delivery of a product or part to a customer. Supply chains have evolved over time and grown in complexity. However, the principle of organising material and information flow is dominant.For example, the supply chain of a refrigerator manufacturer will include sourcing the raw material, transporting the material to the factory, transforming the material into the product, packing it, warehousing it and transporting it to the point of sale or direct to the consumer. Each of these steps has its own complexity, and may involve multiple suppliers. For example, metals, plastics and electronic components are all used in making fridges, various materials and machinery will be needed in the factory for distribution packaging, and transportation may involve several steps by road, rail or sea. Additional factors in the supply chain include information exchange and communication about the product, ordering and payment systems, and the human resources involved in the supply chain from beginning to end.

Supply chain in 2023 and ahead

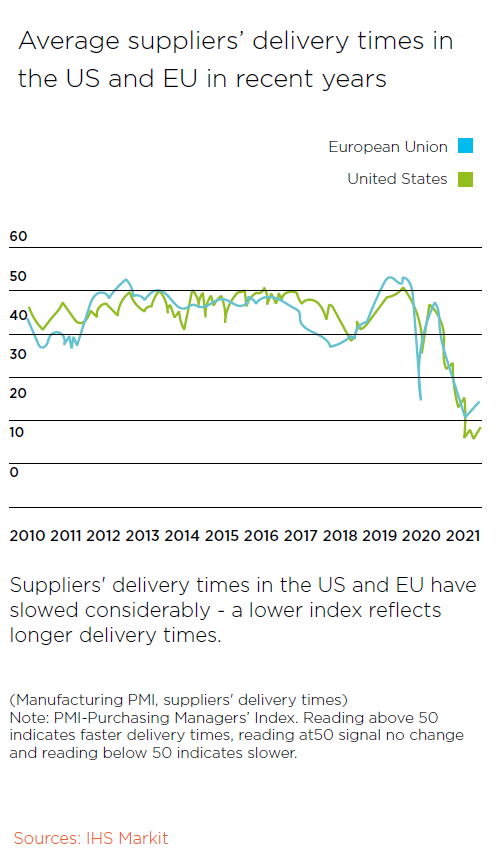

Among the many varied challenges facing today’s manufacturing supply chains not all are new or unexpected, but the rapid succession of significant disruptions within a short period of time has led to significant backlogs and bottlenecks, resulting in an increase in suppliers’ delivery times of nearly twofold in 2020 and 2021.

There are factors within these big challenges for now and the future which companies can control to some extent, while others are less manageable.

Managing these challenges

Analysing and strategising company supply chain

Even before all the unprecedented recent disruptive global events, mapping out a supply chain was one of the critical steps in performing an analysis in a strategic planning process.

This analysis gives the company oversight in understanding all the other players involved in each stage of its supply chain, allowing it to plan the best ways to manage its business flow in an agile and flexible manner.

In the present uncertain times, some of the major supply chain factors that companies have to plan for and respond to in order to remain competitive, even if they cannot control them, are unexpected events such as Covid 19, fuel cost fluctuations, port holdups and other distribution bottlenecks, reduced transport availability. Longer term factors are climate change, with its myriad effects in terms of, for example, extreme weather events and related human behaviour and choices, availability of critical materials, and staff and skills shortages. To stay ahead of the game and be as responsive as possible, companies are focusing on the areas they can control, such as digitisation, changes to the amount of stock they hold, managing supplier relationships in different ways, and attracting and retaining skills."Spanning multiple companies, geographic locations, time zones, and political systems, modern supply chains are intricate systems themselves”

Investing in digitisation

Building on a trend that was already underway before Covid 19, but which the pandemic has accelerated, large manufacturers are investing in digital transformation to enable early insights by better forecasts, predictive analytics and risk detection, more flexibility with data sharing, and added value by creating transparency in the supply chain. A forward-looking overview enables more speed, flexibility, precision, sustainability, and can reveal possible new business models. Enhancing the accuracy of demand fluctuations through digitisation provides insights that can be fed into a company’s Sales & Operations areas.

Of course, moving to greater digitisation brings the need for mindset change and for confronting issues around existing data collection systems, costs, disparities in supplier partners’ investments in their own digitisation, and how to manage the increasingly large amounts data generated by the new systems.

One mindset change boosted by Covid 19 was an increased willingness to collaboratively share data between companies to manage time-saving and keep stock moving as much as possible. During the pandemic, the disruption meant that far more discussions than usual between suppliers and customers were constantly needed to coordinate and avoid bottlenecks. However, even in the most digitally advanced industries, most of this ‘emergency’ communication is analogue, taking place by telephone or email, with all the inherent risks such as incorrect or incomplete record keeping. More and more companies are therefore seeing the need to aim for an end-to-end digitisation of the supply chain, involving not just their own internal systems, but also that of their suppliers.

One of the challenges most companies face even internally is the issue of using several IT systems in parallel that are not or only partly connected and interoperable. This makes it difficult to combine data and to trace relationships and dependencies between data. Knowing that it will be difficult to keep all IT solutions on one single IT system, large manufacturing companies plan to develop or employ dedicated platforms with a common software architecture to integrate different data from production and logistics throughout the company and for different brands.

In dealing with these supply chain data exchange needs, cloud platforms are playing an increasingly important role, by enabling a cross-company collection of data and a sharing mechanism for supply chain partners. This is helpful where it is not feasible to integrate the partners’ systems into the company’s, so the cloud platform is used as an add-on to the internal systems, and can be shared by the different entities. In cases where near real-time data is shared, those platforms have the potential to allow a quick reaction of supply bottlenecks or demand fluctuations. A further challenge involved in the move to greater digitalisation is the ever- increasing amount of data generated. Companies need to find ways to minimise this, streamlining its collection and handling to avoid high storage costs and reduce the amount of time staff spend managing it.

Companies not only recognise the need for digitalisation for their own cost and efficiency purposes, but they are also being impelled by changes in regulations. For instance, several manufacturing companies envisage sharing operational data on transportation and goods receipt and sustainability datasets to enable compliance towards the required transparency demanded by the European Supply Chain Act or the European Due Diligence Directive.

Cybercrime and digitisation

Unfortunately, along with its undoubted advantages, increased digitisation also brings an increased risk of cybercrime, with sophisticated criminals finding ways to infiltrate supply chains and damage businesses. So an awareness of these threats, and the installation of trusted supply chain security systems to protect data, such as blockchain or other suitable programmes, is vital.

Materials shortages

Global events over the last few years have influenced a move towards ‘friend shoring’ and ‘nearshoring’ where industry leaders are exploring trade links with neighbours as a means of overcoming gaps in the flow of materials from further away. When considering such changes to established supplier networks, careful analysis of the implications is needed. What will it mean for a company if they cannot source a key material or component? They may have to reformulate the product and this may impact on regulatory or customer approval. And what are the cost impacts from sourcing from new markets or suppliers: these could be positive or negative.

Just-in-Case vs Just-in-time

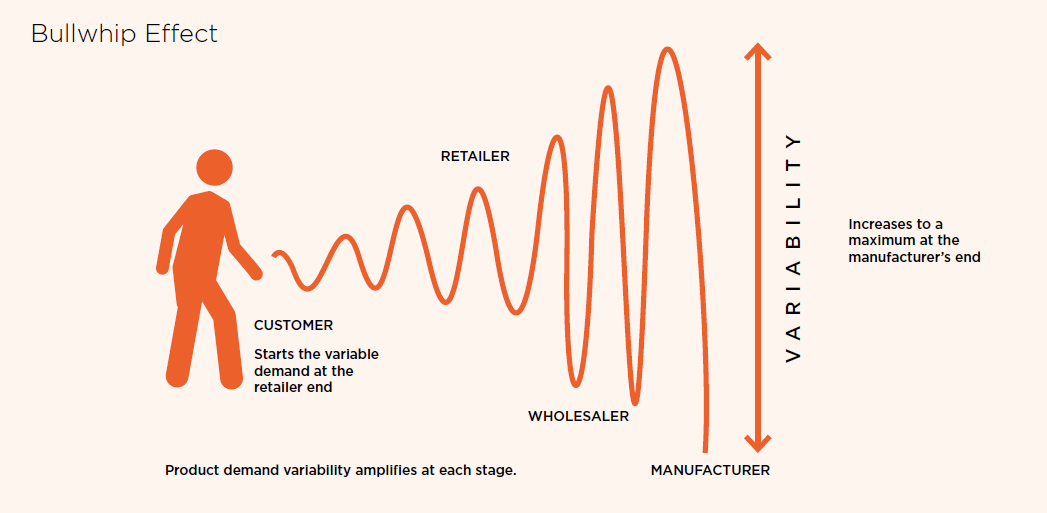

A consequence of the recent global disruption has been that many companies are having to employ the Just-in-Time (JIT) inventory system rather than Just-in-Case (JIC). JIT aligns raw-material orders from suppliers directly with production schedules, increasing efficiency and reducing waste for manufacturers who receive goods only as they need them for the production process, thus keeping down inventory costs. This system requires great accuracy in forecasting. Clearly, recent global events have impacted on the ability of supply chain actors to make accurate forecasts, so they have had to rapidly move to a new mindset. In fact, capital tied up due to inventory plays a fairly minor role, while the availability of critical material is of greater importance. A downside of the change to JIC is that as the bullwhip effect ripples up through the system, forecasting becomes more and more inaccurate, creating excesses of stock throughout the pipeline, hitting the manufacturer the hardest. Very likely the manufacturer will be holding much greater amounts of inventory than before Covid 19, and may be paying high rents on external warehouses. As internal and external warehouses fill up, operative flow processes are affected, waste is created, and the effect of missing parts and goods has an immediate effect on the production of finished goods.

Manufacturers can take various steps to mitigate these problems:

• Tailored inventory holding for specific material, parts, and components

• Retain as many JIT processes as possible

• Increased timelines for approval of material purchases at the supplier

• Shortening of timelines for production approvals to ensure correct versioning of parts and components

• Enhanced supplier development with focus on parts availability: multiple suppliers with focus on the availability of parts rather than as previously on quality and process improvement

New approaches to partnerships

SustainabilityAn important factor today when building new supplier partnerships or developing and adapting existing ones is sustainability. Regulatory bodies and customers are bringing increasing pressure on manufacturers to implement ecological criteria such as CO2-neutral production and to adhere to social standards. Certainly buying costs remain the central criterion for companies when selecting suppliers, but the impact of Environmental, Social and Governance (ESG) scrutiny is also influencing their selection processes.

In aligning their internal goals with regulatory sustainability requirements, companies are also meeting an important and growing consumer demand for effective and verifiable ecological credentials. And so, many companies are increasingly imposing regulations on their suppliers to comply with their internal goals.

Incorporating supply chain sustainability considerations early in the product development process, e.g. product design for supply chain adaptations or even recycling processes, becomes increasingly important.

The need to set up processes for recycling and the need for reduction in transport emissions to enable a product CO2 neutrality will accelerate a transition to regional, circular supply chains, ideally leading to zero waste.

Returning once more briefly to the topic of digitisation, we can see how it touches all areas of the manufacturing industry. With sustainability, it enables the setting up of more climate-friendly production processes. The technology is now available to digitally trace material flows throughout the entire supply chain to provide transparency and security, and enable consumers to have a verifiable and trustworthy overview of the whole supply chain process, so they can make informed purchase choices in line with their values.Supply chains of the future

In the past, supply chains were typically configured for running on a long-term basis, prepared for known risk events. The disruptive events of recent years, however, pushed companies to rethink their approach to resilient strategies. Companies realised that not all risk events can be prepared for. Especially unexpected risk events like Covid 19, but also exceptional high impact events like the blockage of the Suez Canal, require different methods and approaches for the management of supply chains. This has brought about a shift of paradigm from resilience to adaptiveness.

The implementation of adaptive supply chains means that advanced and future supply chains will be more dynamic with temporary settings, sometimes created on-demand in order to better cope with supply risks, market demands and volatility in volumes. In some cases, this will reflect in a more complex and wider network of supply chains as frequent changes broaden the number of suppliers and customers.

Digitisation will be the foundation of these future adaptations, underpinned by agile and forward-thinking leadership and an upskilled workforce.

Copyright © Homa2023

Allrights reserved

.jpg?VGhlIFBlcmZlY3QgU2xvdC1pbijmraPnoa4pLmpwZw==)

.jpg?MTkyMHg3MjDvvIhkZXPvvIkuanBn)

.jpg?MTAyNHg3NDDvvIhkZXPvvIkuanBn)